Picture shows the Dollar rate rising in Pakistan taken form Propakistani published on 23.11.2022

Newsnomics AJAY ANGELINA reporter | Currently, Pakistan’s cost of insuring exposure to five-year sovereign

debt rose by 1,224 basis points over the weekend hitting the highest ever level of 92.53%, a brokerage's data

showed on Monday.

Experts say “a CDS (Credit Default Swap) is a measure of premium to insure a credit risk. 92% CDS for

Pakistan means that someone is willing to pay 92 cents to insure their $1 loan. Importantly, it also means that someone is not willing to take on this risk at a price level lower than 92 cents.”

“The situation on the ground is challenging but not as grave as reflected by the current Credit Default Swap (CDS) rate,” an analyst said. “The margin for any misadventure was thin, for sure.”

Analysts said the country’s sovereign dollar bonds would remain vulnerable until the political standoff between the government and the Imran Khan-led PTI settles.

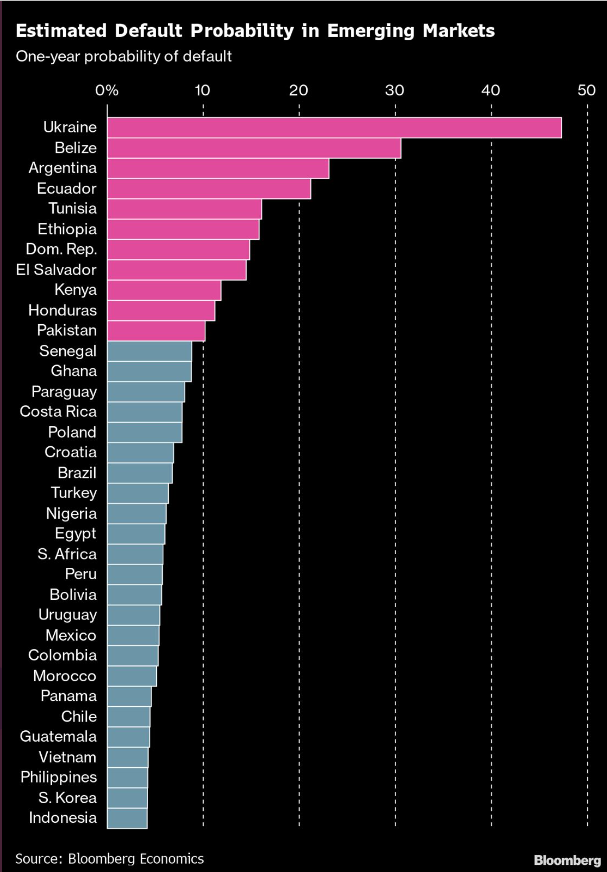

Khurram Schehzad, CEO of the Alpha Beta Core financial advisory firm, said the country’s probability of defaulting on its obligation was not too high to panic. “Pakistan's credit default risk, measured appropriately by

probability of default, is only around 10%,” Schehzad said in a tweet on Nov 22, citing data from Bloomberg

Economics.

He said it was totally opposite to unnecessarily hyped, wrongly explained and most-illiquid CDS, and their

price distortions. “Credit Default Swap (CDS) is an insurance and there is a lot of difference between

probability of default and buying insurance on an asset to protect repayments, which depends on investors,”

Schehzad added.

Last week, Federal Minister for Finance and Revenue Ishaq Dar rejected all speculations surrounding oil

shortage and widening credit default swap, terming them "baseless rumors being spread on political goals".

Pakistan is scheduled to repay $1 billion against a five-year Sukuk (Shariah-compliant bond) maturing on December 5, 2022. The CDS increase indicates that investors were worried that the country would miss its obligation to repay credit holders $1 billion because the Sukuk is due to mature.

Addressing a press conference via video link, the finance minister asserted that Pakistan will “absolutely not”

default on its debt obligations. The country’s next big payment — $1 billion in international bonds — is due

in December, and Ishaq Dar assured the people that payment would be met on time.

“We have never defaulted before. We will not even be close to default … Let me clear this categorically that

the bond will be paid and there is no delay in this and even arrangements have been made in principle for

upcoming payments in the next year,” he reiterated.

Fahad Rauf, the head of research at Ismail Iqbal Securities said an important event would be the upcoming

$1billion payment on Sukuk, which would give confidence to the market.

“Pakistan is likely to remain in the IMF program, even after the end of the current program, which would help Pakistan in managing debt payments. However, serious reforms are required to reduce the increasing debt

levels in the economy i.e. (1) conserve energy, (ii) increase tax base, (iii) focus on exports, and (iv) attract FDI,”

Rauf said.